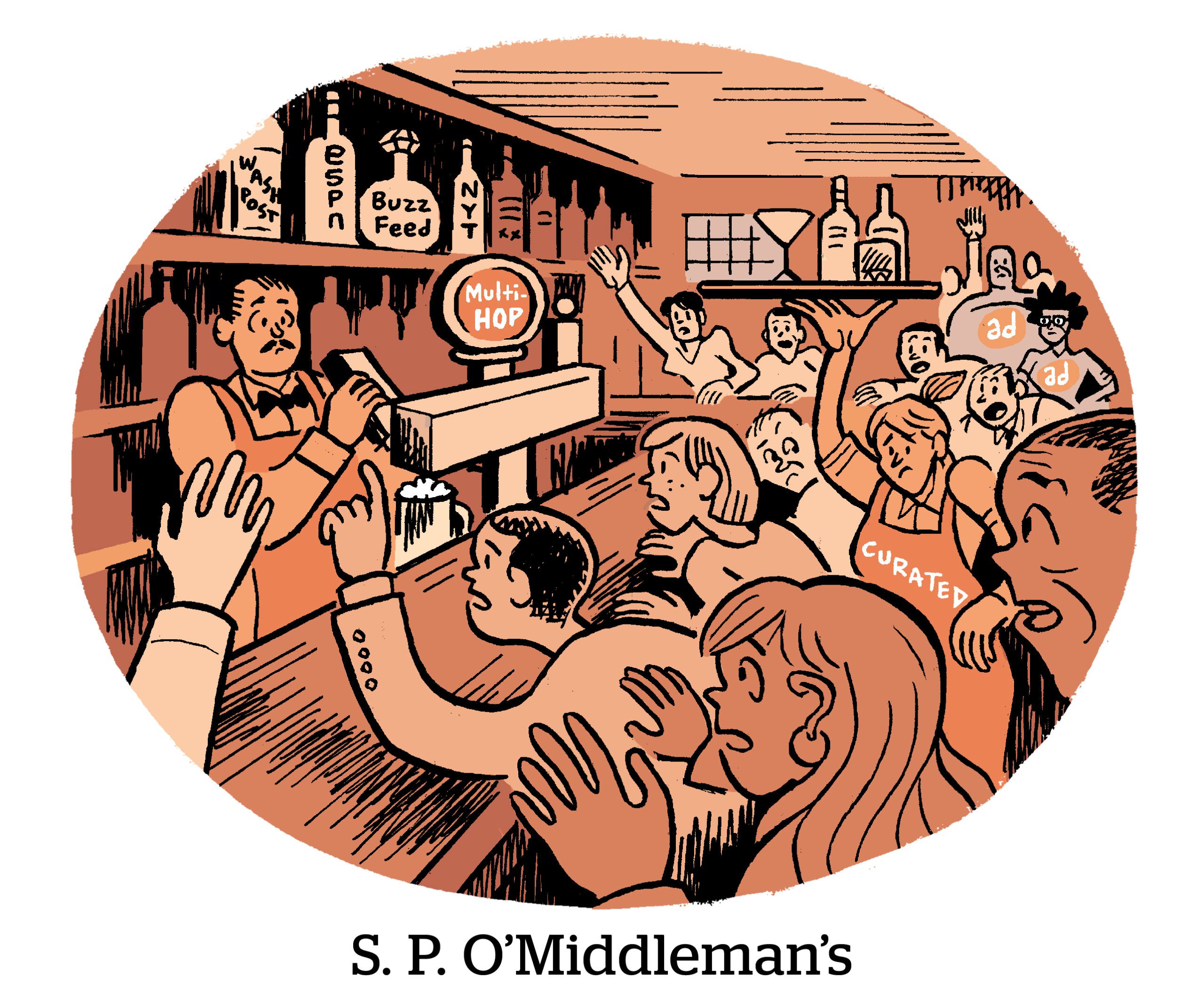

The impending deprecation of third-party cookies (any day now, really, we mean it) is changing how ad tech companies build audiences for media buyers.

Sell-side curation is emerging as a post-cookie trend. It involves matching a buyer’s first-party customer data to a publisher’s first-party audience data to create private marketplaces (PMPs).

To be clear, deal curation is nothing new. PMPs have been a thing for a while.

But the audience matching that powers curation is no longer only happening at the DSP level, where it typically relies on third-party cookies. Now, SSPs are building curated marketplaces while hyping their closer connections to publisher first-party data.

This shift is changing the role DSPs, SSPs and data management platforms (DMPs) play to enable targeting. And it’s giving DSPs less control over how advertisers curate audiences, which is creating new tensions in the programmatic ecosystem.

Transforming the supply chain

Sell-side curation is having a moment because signal loss is forcing marketers to get creative in how they target audiences across publishers.

“The industry is migrating to SSP curation as a response to cookie deprecation,” said Miles Pritchard, a partner at OMD focused on data and technology transformation.

Previously, an advertiser would curate custom audiences by sending an audience brief to a data provider that has a cookie-based ID integration with a DSP. Then, within 36 hours or so, that audience would show up in the DSP, Pritchard said. But as web browsers began phasing out third-party cookies, it became harder for data providers to push custom audiences into DSPs in the same way.

However, SSPs can offer a similar service based on first-party data sourced from their publisher partners, while also bringing in data from other sources.

“This is perhaps one of the only mechanisms that may survive the loss of third-party cookies that still allows large-scale activation of second- and third-party audiences in a programmatic open marketplace,” Pritchard said.

Advertisers are also taking a cue from the supply-path optimization trend and going directly to the partners they already work with to build PMPs. In a marketplace increasingly dominated by first-party data, those partners are on the sell side.

Sell-side data marketplaces

Curation’s shift from the buy side to the sell side is accelerating as SSPs strike partnerships with third-party data providers like Experian and TransUnion as a way to improve match rates between buyer and seller audience graphs.

In that sense, SSPs are building their own data marketplaces where buyers can pay to add additional audience data layers to their campaign targeting. In the past, such data marketplaces were mainly only available through DSPs.

These partnerships with third-party data providers also help SSPs stand out – and perhaps even compete with DSPs – as buyers optimize their supply paths to include fewer trusted partners. For example, Microsoft Advertising’s Xandr, PubMatic and Magnite each partnered with Experian last year.

SSPs see this shift as an opportunity to differentiate their approach to using data by providing high-quality supply and transparency, said Scott Ensign, chief strategy officer at Butler/Till.

“SSPs, which have always been at the end of the workstream, now can have more strategic conversations with buyers about what they’re buying and why they’re different from the next dozen SSPs,” Ensign said.

The sell-side curation trend is also prompting DMPs – which facilitate audience matches between publishers, data brokers and buyers – to rebrand themselves as curation specialists. Audigent and Lotame, for example, two DMPs that now identify as curation platforms, also have integrations with Experian.

Marketers can target Experian audiences through all of these integrations, said Kimberly Gilberti, chief product officer at Experian Marketing Services. But each platform applies Experian’s data graph to curate audiences in unique ways based on client preferences, which helps SSPs and DMPs differentiate.

In addition to matching data sets between partners, DMPs can also use lookalike modeling to scale a campaign’s reach beyond a buyer’s known customers and across multiple publishers. SSPs package the resulting audience into a PMP. The SSP assigns that PMP with a deal ID that can be sent to DSPs, allowing the brand’s agency to buy impressions associated with that PMP programmatically.

For example, Butler/Till buys local media for 16,000 individual State Farm insurance agents, Ensign said. Roughly 80% of those agents buy media programmatically.

Butler/Till, in partnership with Audigent, has set up curated programmatic marketplaces that focus on different consumer life stages. The Experian data graph helps facilitate audience matches for these life stages by identifying users who have recently had children or purchased a new car or house.

By targeting these audiences, the campaign can optimize more efficiently than if Butler/Till bought inventory across an SSP’s entire local media network.

Streamlined reporting

Because SSPs manage the programmatic auction, they can also match advertiser data sets to third-party data graphs and publisher first-party data in real time, eliminating the need to wait at least a day for the curated audience to show up in a DSP.

Real-time signals allow partners to share measurement and reporting data far more quickly.

When curation happens at the DSP level, a DMP has to “wait 30 to 90 days to get a report and see if anyone bought our data,” said Drew Stein, founder and CEO of Audigent. But when an SSP curates inventory, DMPs can see who’s activating their data in real time, he said.

That immediate transparency between partners is one reason DMPs are so bullish on the sell-side curation trend. It’s helping them secure a spot in the supply chain despite advertisers looking to cut out middlemen.

Audience providers are attempting to be the connective tissue between all of these different ID graphs, Pritchard said.

“That’s overlapping with the clean room revolution, and companies are rebranding themselves under those terms as well,” he said. “The whole trend points toward having a more connected experience when it comes to trading and activating audiences, and a more direct relationship between buyer and seller.”

Gatekeeping alternative IDs

Plus, because SSPs can send deal IDs to multiple DSPs, it allows advertisers to be DSP-agnostic when it comes to curation, rather than the old way of only being able to curate certain audiences within certain DSPs, Pritchard added.

Sell-side curation also gives advertisers more flexibility to use alternative identifiers, rather than being limited to whatever alternatives the DSP supports.

Which is important, because DSPs often restrict which IDs can be used on their platforms, said Eli Heath, head of identity, global partnerships and product at Lotame. Sell-side curation avoids this DSP gatekeeping.

“We just transact on a deal ID that any DSP can interoperate with because they don’t actually have to look at the identifier within the bid request,” Heath said. “All that audience matching for the DMP segment has been prequalified upstream by the SSP.”

For example, Lotame’s curation solution uses its proprietary Panorama ID to activate audiences in Safari and Firefox via cookieless integrations with SSP platforms, Heath said. But The Trade Desk prefers to use its UID2 alternative ID and doesn’t support the Panorama ID. Meanwhile, Google DV360 won’t support any cookieless identifiers other than encrypted publisher-provided IDs.

(Lotame has an ID integration with The Trade Desk, but that partnership just allows Lotame to share audience data with The Trade Desk so it can be translated into a UID2.)

However, Heath said, using a sell-side curation approach, Lotame can ship its audiences to an SSP like PubMatic or Magnite and find matches to Panorama IDs across publisher sites. The SSP then packages that audience into a targetable deal ID and ships the deal ID to the DSP without the DSP actually knowing which alternative ID facilitated the audience matching.

DSPs strike back

DSPs are starting to bristle at any lack of transparency and loss of control over audience curation.

They’ve been raising the alarm about a lack of insight into so-called ID bridging, with DSPs claiming they can’t trust certain cross-platform probabilistic audience matching because they don’t know which ID solutions were used to build those segments.

The lack of transparency and loss of control that DSPs are objecting to will only become more pronounced with the deprecation of third-party cookies as post-cookie targeting solutions come to rely on first-party data and closer integrations with publishers.

But SSPs aren’t likely to cede their new powers anytime soon. They caught on fairly quickly that curation is “a vehicle for them to rise up the food chain,” Pritchard said.

“Now they’re fighting a more upstream war around consultation and how well they can take a brief and turn it into [a curated audience] through their partner integrations,” he said. “It feels like an arms race.”